Market Pulse

Futures are modestly green this morning — S&P +0.17%, Dow +0.20%, Nasdaq +0.14% — but the real story is what's about to land: the delayed January jobs report. Consensus expects 70,000 nonfarm payrolls, unemployment at 4.4%, and wages up 0.3% month-over-month. This is the number everyone's been waiting for since it got pushed back.

Yesterday was another day of Dow dominance. The blue-chip index notched its third consecutive record close at 501.90 (via DIA), while the Nasdaq slipped 0.62% — the divergence between old economy and tech continues to widen. The S&P drifted lower by 0.41%. This is exactly the environment THOR's system detected weeks ago.

The global picture is loud. Fortune ran a headline this morning about "American unexceptionalism" — the U.S. sitting near the bottom of global performance rankings. The Nikkei surged 2.28% overnight, Europe is mixed (STOXX 600 -0.23%, FTSE +0.47%), and the dollar's 10% decline over the past year is making foreign returns look even better on a currency-adjusted basis.

Gold is consolidating around $5,025–$5,050 after pulling back from its $5,608 January peak. Still up ~73% year-over-year. The correction looks healthy, not concerning.

Bitcoin continues its slide to ~$69,000, down from $126,000 in October. RSI is oversold at 28-30, open interest has collapsed from $95B to $45B. Prediction markets give 42% odds BTC hits sub-$60K this month. Fear is elevated.

10-year Treasury yield sits at 4.13%, with the Fed holding at 3.50-3.75%. The Powell DOJ probe drama continues — Senate Banking Chair Tim Scott said last week Powell committed a "gross error in judgment" but no crime. The irony: this probe may actually extend Powell's tenure by creating political roadblocks for Trump's Warsh nomination.

Earnings: Cisco reports after the close today. Yesterday's slate included Coca-Cola, CVS, Duke Energy, Marriott, Ferrari, and Ford.

The THOR View

Here's what the data is showing — and it's not complicated.

The Dow is making records. The Nasdaq is fading. Tech concentration is a liability, not an asset, in this environment. The THOR SDQ Index Rotation has been positioned for exactly this: 50/50 Dow and S&P, Nasdaq essentially off. When 60% of the Nasdaq is tech and tech isn't trending, the rotation math is straightforward.

The "American unexceptionalism" narrative is interesting, but here's what matters for positioning: within the U.S., the rotation away from tech and toward broad market and value is the signal. The THOR Low Volatility Index has 7 of 10 sectors risk-on with Tech, Financials, and Real Estate off. Materials led yesterday (+1.46%), Utilities were strong (+1.03%), Real Estate popped (+1.34%). The sectors THOR is invested in are working.

Today's jobs number could move everything. A strong print keeps the Fed on hold longer and supports the current regime. A weak print reopens the rate cut debate. Either way, the system is positioned — heavily invested, broad exposure, tech-light. If the data changes, the positioning changes. That's the feature, not the bug.

Signal Watch

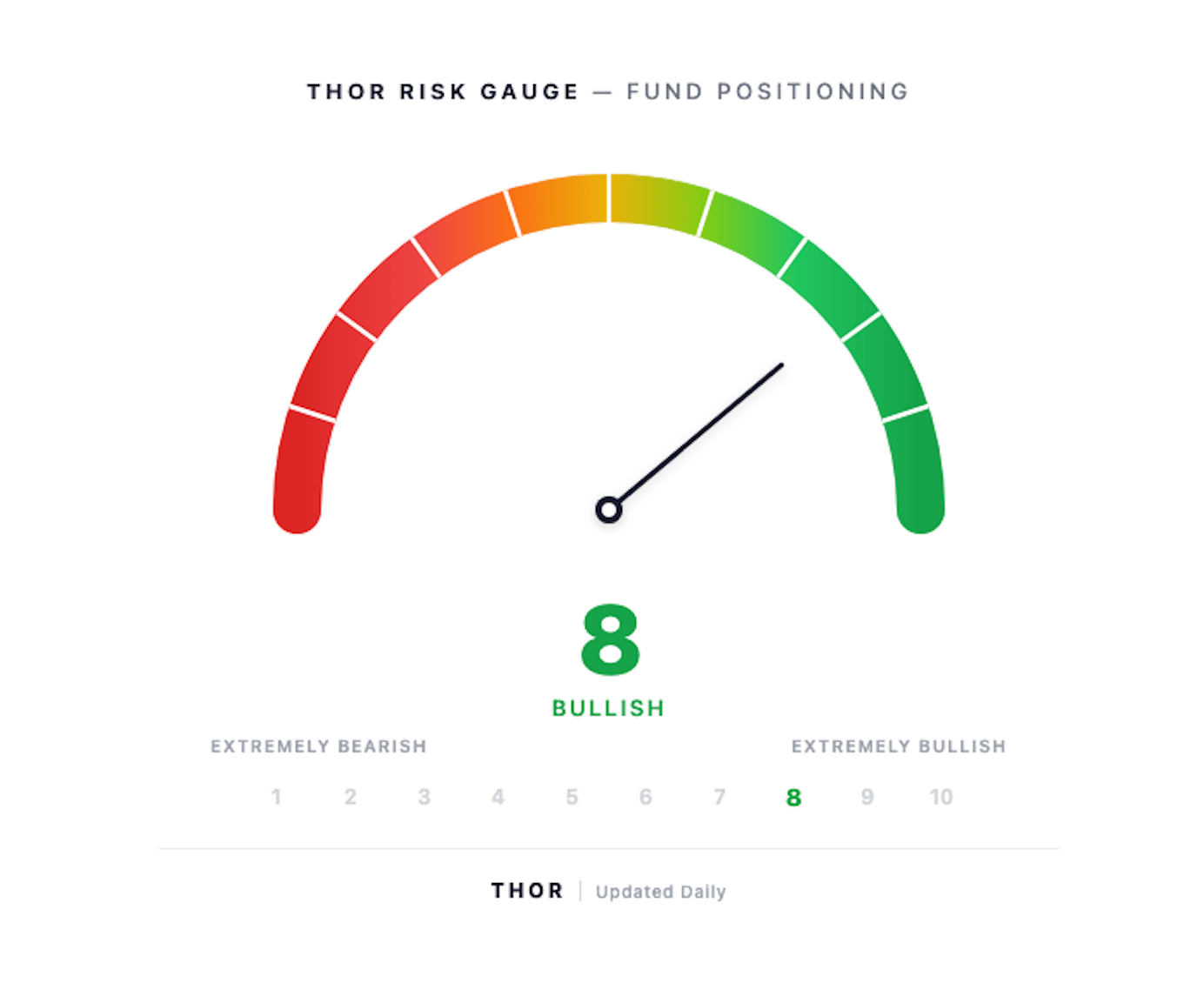

THOR Risk Gauge: 8 — Bullish

Score unchanged — near fully invested across both funds, broad/value tilt, stable positioning.

THOR SDQ Index Rotation — Current Positioning

Index | Signal | Weight |

|---|---|---|

Dow Jones (DIA) | 🟢 RISK ON | 49.0% |

S&P 500 (SPY) | 🟢 RISK ON | 48.5% |

Nasdaq 100 (QQQ) | 🔴 RISK OFF | 0.5% |

Cash (BIL) | — | 0.9% |

THOR Low Volatility Index — Current Positioning

Sector | Signal | Weight |

|---|---|---|

Materials (XLB) | 🟢 RISK ON | 15.0% |

Energy (XLE) | 🟢 RISK ON | 14.6% |

Industrials (XLI) | 🟢 RISK ON | 14.4% |

Consumer Disc (XLY) | 🟢 RISK ON | 14.1% |

Consumer Staples (XLP) | 🟢 RISK ON | 14.0% |

Healthcare (XLV) | 🟢 RISK ON | 13.2% |

Utilities (XLU) | 🟢 RISK ON | 12.6% |

Technology (XLK) | 🔴 RISK OFF | 0.5% |

Financials (XLF) | 🔴 RISK OFF | 0.4% |

Real Estate (XLRE) | 🔴 RISK OFF | 0.0% |

Cash (BIL) | — | 0.9% |

Holdings as of 1/30/26. Positioning unchanged from last edition.

One Thing to Watch

The January jobs number drops before the open. Expectations are low (70K payrolls, 4.4% unemployment) because this report was delayed and January is seasonally messy. But the market's reaction matters more than the number itself. Watch how the 10-year yield responds — that's your tell for whether the "higher for longer" narrative holds or cracks. If yields spike on a hot number, the Nasdaq divergence gets worse. If they drop on a miss, the rate cut trade comes back fast. Either way, THOR's positioning is set.

The Signal is published weekdays by THOR Funds. Current positioning reflects live ETF holdings as of the most recent rebalance. This is not investment advice — it's what the data is showing. Past performance doesn't guarantee future results.

This content reflects the opinions, analyses, and research of THOR Financial Technologies as of the date published. It is provided for informational and educational purposes only and does not constitute investment advice and should not be relied upon as the basis for any investment decision. Past performance doesn't guarantee future results, and all investments involve risk.