Market Pulse

Futures are calm this morning — S&P 500 up 3.5 points to 6,986.75, Dow futures +29 to 50,248, Nasdaq essentially flat at 25,344 (-10). Russell 2000 futures +2.6 to 2,698.70. After last week's Dow 50K milestone, markets are catching their breath.

The real action was overseas. Japan's Nikkei 225 surged 2.28% to a record 57,650 — the biggest move in weeks — after Sanae Takaichi's landslide election victory and expectations of pro-market reforms. Hong Kong's Hang Seng added 0.58%. Europe is flat (DAX -0.03%, FTSE -0.26%).

Gold is holding above $5,000 at $5,072.50 (COMEX April), down just 0.14%. Silver at $81.82. Oil ticked up to $64.54 WTI (+0.28%) on U.S.-Iran tensions in the Strait of Hormuz — the U.S. is urging ships to stay "as far as possible" from Iranian waters after boarding attempts.

Bitcoin is struggling around $69,000 — down roughly 46% from its October all-time high of $126K. The Crypto Fear & Greed Index sits at 14 (Extreme Fear). This isn't a dip. This is a regime change in crypto sentiment.

10-year Treasury yield: 4.182% (-1.6 bps). Yields continue to drift lower with one-year inflation expectations at 3.1%, the lowest in six months. That's the quiet story underneath everything.

VIX: 17.45 (+0.52%). Elevated but not alarming.

The THOR View

Here's why today's quiet morning matters: the week ahead is packed with market-moving data.

Jobs report Wednesday. Consumer inflation (CPI) Friday. Those two prints will determine whether the "soft landing confirmed" narrative holds or cracks. Futures may be calm now — they won't be calm Thursday morning.

Meanwhile, the THOR system's positioning tells you something. THOR SDQ Index Rotation is running 50/50 Dow and S&P 500 with Nasdaq essentially off. THOR Low Volatility Index has 7 of 10 sectors risk-on — with Technology, Financials, and Real Estate turned off.

Japan's record rally is interesting context. Capital is finding a home in value-oriented, reform-driven markets. That aligns with where THOR is positioned: Dow and S&P (broad, diversified) over Nasdaq (concentrated tech). Materials, Energy, Industrials — the real economy — over the AI narrative.

Gold above $5,000 and yields drifting lower? That's the bond market quietly saying "we see the slowdown." China telling its banks to reduce U.S. Treasury exposure adds another layer. The dollar is weakening (USD/JPY down to 155.17).

The system doesn't care about narratives. It cares about structural trends. Right now, the structural trend says: stay invested, stay diversified, avoid tech concentration.

Signal Watch

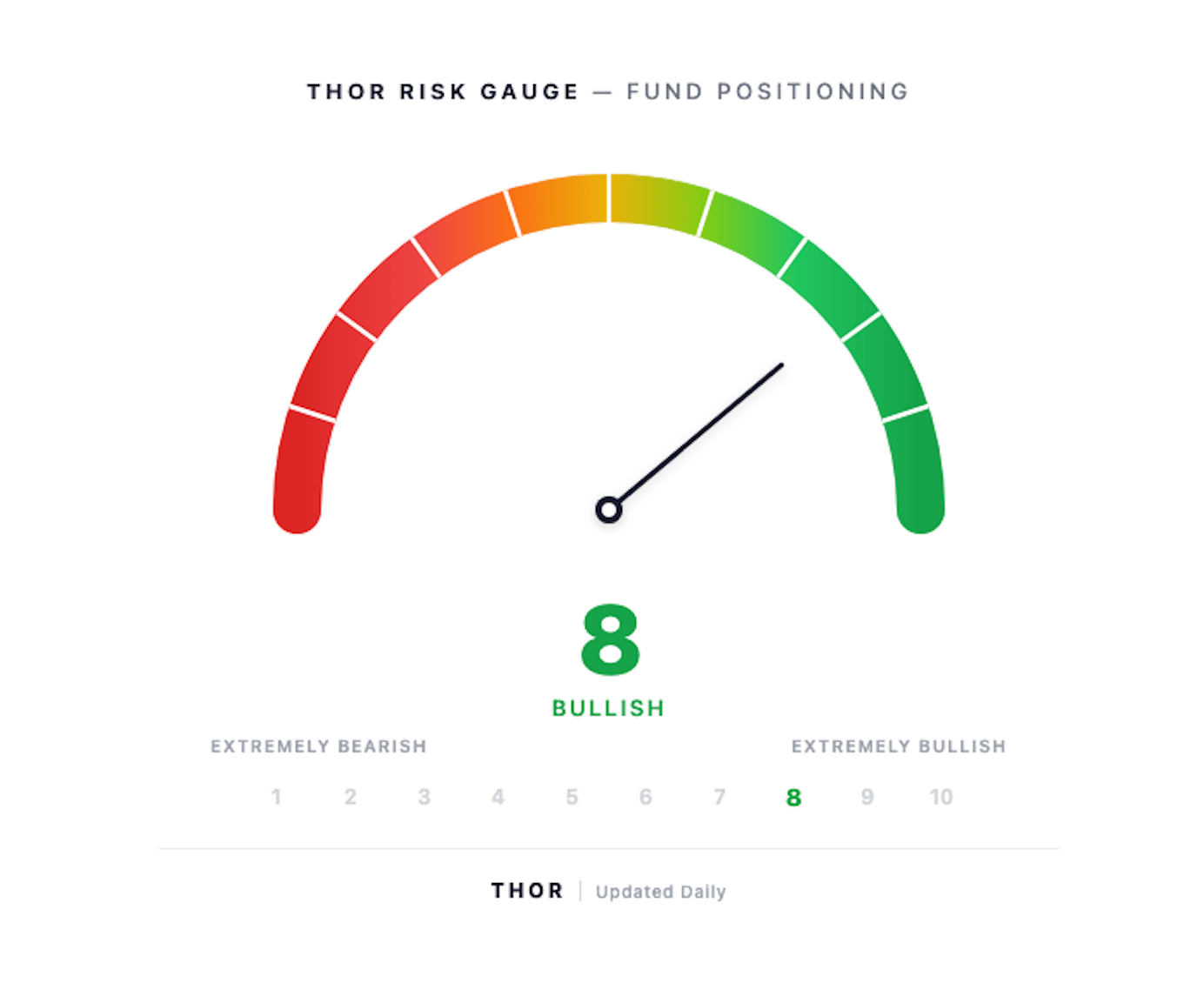

THOR Risk Gauge: 8 — Bullish

Score unchanged. Both funds remain heavily invested with strong conviction. No positioning changes since January 30.

THOR SDQ Index Rotation — Current Holdings

Index | Ticker | Weight | Signal |

|---|---|---|---|

Dow Jones | DIA | 49.02% | 🟢 RISK ON |

S&P 500 | SPY | 48.48% | 🟢 RISK ON |

Cash | BIL | 0.93% | — |

Nasdaq 100 | QQQ | 0.53% | 🔴 RISK OFF |

As of 1/30/26. Nasdaq OFF — tech concentration reduced.

THOR Low Volatility Index — Current Holdings

Sector | Ticker | Weight | Signal |

|---|---|---|---|

Materials | XLB | 14.97% | 🟢 RISK ON |

Energy | XLE | 14.58% | 🟢 RISK ON |

Industrials | XLI | 14.41% | 🟢 RISK ON |

Consumer Disc | XLY | 14.08% | 🟢 RISK ON |

Consumer Staples | XLP | 14.02% | 🟢 RISK ON |

Healthcare | XLV | 13.20% | 🟢 RISK ON |

Utilities | XLU | 12.63% | 🟢 RISK ON |

Cash | BIL | 0.90% | — |

Technology | XLK | 0.54% | 🔴 RISK OFF |

Financials | XLF | 0.42% | 🔴 RISK OFF |

Real Estate | XLRE | 0.00% | 🔴 RISK OFF |

As of 1/30/26. 7 of 10 sectors risk-on. Tech, Financials, Real Estate OFF.

One Thing to Watch

Wednesday's jobs data and Friday's CPI are the entire week. Everything else is noise. If jobs come in hot and CPI ticks higher, the "rate cuts are coming" trade unwinds fast. If both cool, the soft landing narrative strengthens and this market has another leg higher. The system is positioned — 97%+ invested, broad market exposure, tech underweight. It's ready for either outcome. That's the point.

Earnings Today

Coca-Cola, TSMC (January revenue), Gilead Sciences, S&P Global, Spotify, and Robinhood all report today. Coca-Cola and TSMC are the ones that matter — consumer staples health and semiconductor demand are both macro barometers.

The Signal is published weekdays by THOR Funds. Current positioning reflects live ETF holdings as of the most recent rebalance. This is not investment advice — it's what the data is showing. Past performance doesn't guarantee future results.

This content reflects the opinions, analyses, and research of THOR Financial Technologies as of the date published. It is provided for informational and educational purposes only and does not constitute investment advice and should not be relied upon as the basis for any investment decision. Past performance doesn't guarantee future results, and all investments involve risk.