Market Pulse

Friday the 13th is living up to its reputation.

Futures are pointing lower again this morning -- S&P 500 at 6,828 (-23), Dow at 49,367 (-156), Nasdaq at 24,674 (-94). This follows yesterday's broad-based selloff that hit tech hardest: the Nasdaq 100 dropped 2.04%, with the Technology sector down 2.65%. The Dow Transportation Average cratered 4%.

What's driving it: The tech rotation that started as a trickle has become a river. AI disruption fears are hammering software and growth stocks as investors reassess what generative AI actually does to margins across the economy. Yesterday's damage was widespread -- Financials down 2%, Energy down 2.2%, Consumer Discretionary down 1.6%. But here's the tell: Utilities rose 1.9% and Consumer Staples gained 1.3%. Money isn't leaving the market entirely -- it's rotating from offense to defense.

The macro backdrop actually looks fine. January CPI (released Tuesday) came in at 2.5% headline and 2.6% core -- the lowest since 2021 on core. Monthly core was 0.2%, below the 0.3% consensus. This should be good news for rate cuts, but the Fed is in no rush: the FOMC held at 3.5-3.75% with a 10-2 vote in January. Meanwhile, the White House nominated Kevin Warsh as the next Fed Chair, adding a layer of policy uncertainty.

Asia followed the U.S. lower overnight. Hang Seng -1.7%, Nikkei -1.2%, Shanghai -1.3%, ASX -1.4%. Europe is mixed and mostly flat -- STOXX 50 -0.09%, FTSE barely green.

The numbers: - Gold: $4,962.50, +0.28% -- stabilizing after yesterday's selloff from near $5,100. Still a structural bid. - Oil: $63.06/barrel, +0.35% -- relatively calm despite the equity chaos. - 10-Year Treasury: 4.115% -- ticking slightly higher despite the risk-off tone. The inflation-is-dead narrative hasn't fully taken hold in bonds. - VIX: 21.47, +3.1% -- elevated but not panicked. The Nasdaq VXN at 26.87 (+15.5%) tells you where the real fear is concentrated. - Bitcoin: Down ~3% -- crypto continues to trade as a risk asset, not a hedge.

The THOR View

This is exactly the kind of environment the system was built for.

When THOR SDQ Index Rotation turned Nasdaq off and moved to a 50/50 Dow-S&P split, it wasn't a prediction about AI or earnings or any specific catalyst. It was the data. The trend data in Nasdaq deteriorated, and the system acted. No emotion, no narrative, no CNBC-fueled gut call.

Yesterday, the Nasdaq dropped 2% while the Dow "only" lost 1.7%. That gap compounds over time.

THOR Low Volatility Index tells an even sharper story. With Technology, Financials, and Real Estate off -- the three worst-performing sectors yesterday -- the fund's positioning avoided the deepest pockets of pain. Meanwhile, Utilities (+1.9%) and Consumer Staples (+1.3%) are among its active holdings. The system didn't just dodge the losers -- it owned the winners.

Does this mean tech is dead? Of course not. But when 60% of the Nasdaq is tech and tech isn't trending, reducing exposure there isn't bearish -- it's math. If the trend reverses, the system will rotate back in. That's the feature, not the bug.

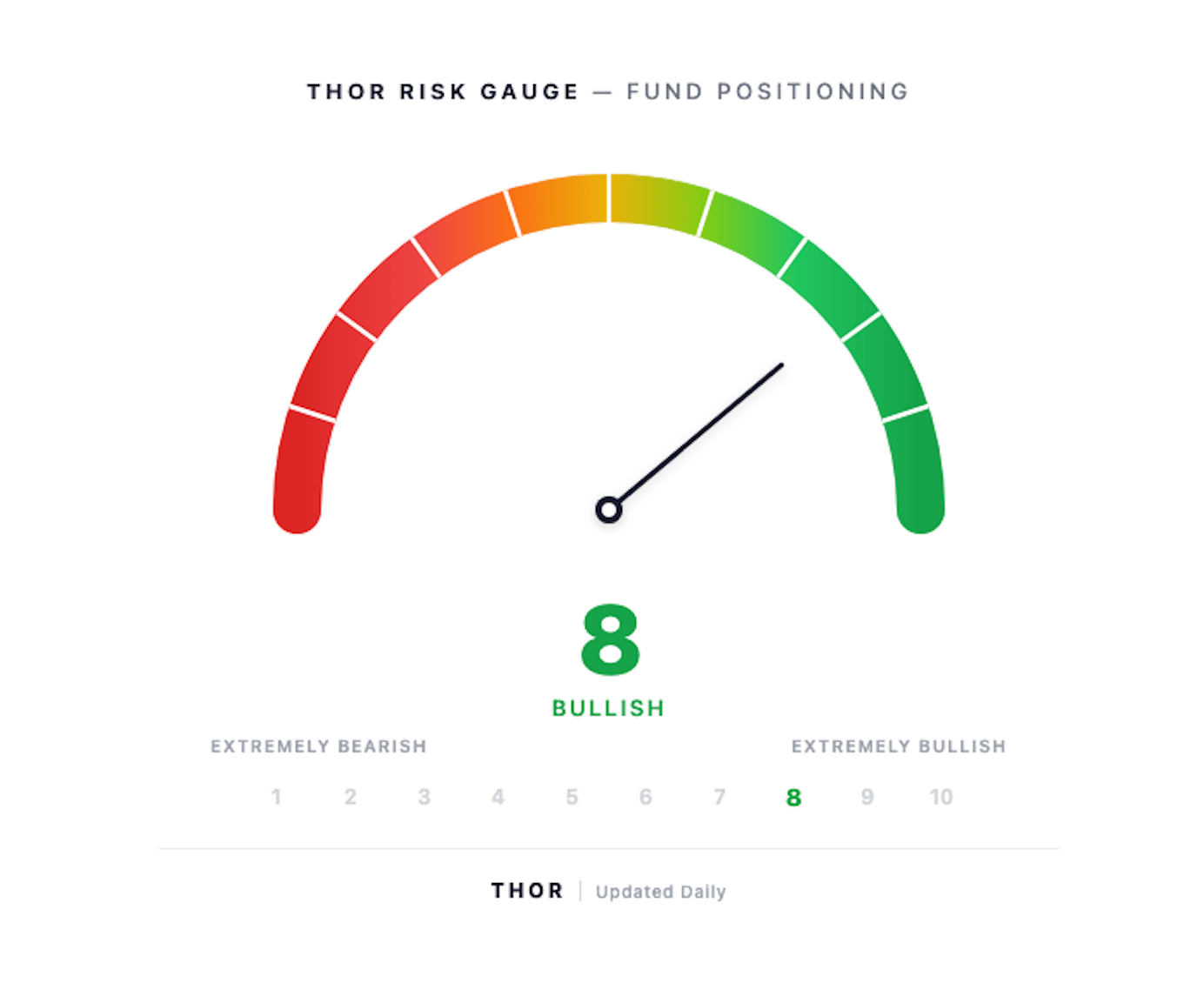

The Risk Gauge stays at 8 -- Bullish. THOR is heavily invested, just not in the places getting hit the hardest. There's a difference between being cautious and being selective. The system is the latter right now.

Signal Watch

THOR Risk Gauge: 8 -- Bullish

Heavily invested, selectively positioned. Avoiding the tech wreckage while staying in the market.

THOR SDQ Index Rotation -- Current Positioning

Index | Ticker | Weight | Signal |

|---|---|---|---|

Dow Jones | DIA | 49.70% | 🟢 RISK ON |

S&P 500 | SPY | 47.84% | 🟢 RISK ON |

Cash | BIL | 0.93% | -- |

Nasdaq 100 | QQQ | 0.50% | 🔴 RISK OFF |

THOR Low Volatility Index -- Current Positioning

Sector | Ticker | Weight | Signal |

|---|---|---|---|

Materials | XLB | 15.52% | 🟢 RISK ON |

Energy | XLE | 14.92% | 🟢 RISK ON |

Industrials | XLI | 14.53% | 🟢 RISK ON |

Consumer Staples | XLP | 14.49% | 🟢 RISK ON |

Consumer Disc | XLY | 13.04% | 🟢 RISK ON |

Healthcare | XLV | 12.86% | 🟢 RISK ON |

Utilities | XLU | 12.77% | 🟢 RISK ON |

Cash | BIL | 0.87% | -- |

Technology | XLK | 0.45% | 🔴 RISK OFF |

Financials | XLF | -- | 🔴 RISK OFF |

Real Estate | XLRE | 0.35% | 🔴 RISK OFF |

Holdings as of 2/12/26. 7 of 10 sectors risk-on. Tech, Financials, and Real Estate OFF.

One Thing to Watch

The Defensive Rotation Has Legs -- Watch Next Week's Earnings

Today's session will tell us whether this tech selloff is a one-week flush or the start of something bigger. The key level: Nasdaq 100 at 24,500. If it breaks, expect the rotation into defensives to accelerate.

But the bigger calendar event is next week. A wave of retail earnings (Walmart, Home Depot) will test whether the consumer is still spending or whether the "soft landing" narrative is fraying. If consumer names hold up while tech keeps bleeding, THOR's current sector positioning -- heavy on Staples, Industrials, and Materials -- looks increasingly right.

The system will tell us. That's the point.

The Signal is published weekdays by THOR Funds. Current positioning reflects live ETF holdings as of the most recent rebalance. This is not investment advice -- it's what the data is showing. Past performance doesn't guarantee future results.

This content reflects the opinions, analyses, and research of THOR Financial Technologies as of the date published. It is provided for informational and educational purposes only and does not constitute investment advice and should not be relied upon as the basis for any investment decision. Past performance doesn't guarantee future results, and all investments involve risk.